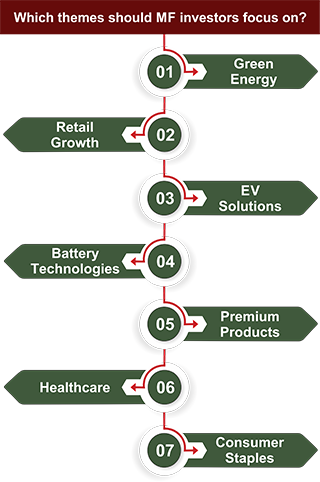

Which themes should Mutual Fund investors focus on?

Thematic funds are expected to attract significant interest in 2025. While these funds carry higher risk due to their concentrated approach, themes focused on structural growth areas, government policies, and global mega-trends have the potential to deliver substantial outperformance compared to more diversified funds. Younger investors with a higher risk appetite are likely to gravitate toward thematic funds in order to capitalize on emerging trends.

Some key themes to watch include:

-

Green Energy and Sustainability: Companies involved in solar, wind, and electric mobility sectors stand to benefit from growing adoption and government incentives.

-

Consumer Discretionary and Retail Growth: Rising incomes and urbanization will drive demand for premium products and organized retail.

-

Electric Vehicles (EVs) and Mobility Solutions: Government policies, along with investments in charging infrastructure and battery technologies, are expected to boost growth in this sector.

Impact of Macroeconomic Factors on Mutual Funds in 2025

-

Equity Funds: High inflation is likely to benefit companies with pricing power, such as those in the consumer staples and energy sectors. However, growth stocks, particularly in technology, may face headwinds due to compressed future earnings expectations.

-

Debt Funds: Rising interest rates are expected to negatively impact long-duration debt funds. Conversely, short-term and floating-rate funds are likely to perform better due to their lower sensitivity to interest rate changes.

-

Defensive Sectors: Sectors like healthcare and consumer staples tend to outperform in high-interest rate environments due to their stable earnings.

Quicklinks

December 26, 2024

December 26, 2024 admin

admin